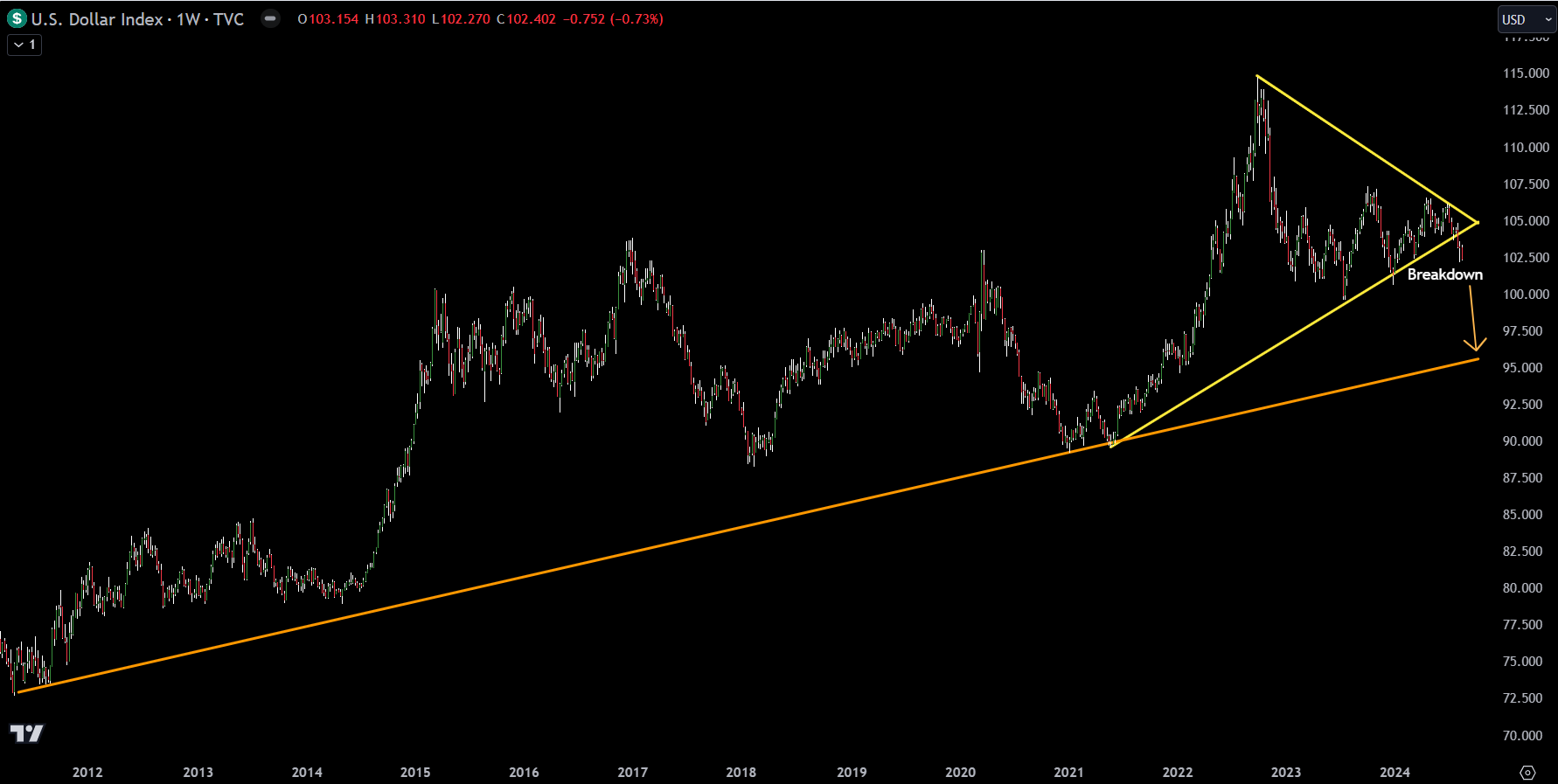

Big Breakdown in the U.S. Dollar

Now is a huge moment for traders.

There is crucial development in the U.S. Dollar Index (DXY) that could signal a significant shift in the market.

As shown in the attached chart, the DXY has broken down from a long-term ascending triangle pattern that has been forming since 2021.

This breakdown is a strong bearish signal and could indicate a deeper correction in the U.S. Dollar in the coming weeks. The chart highlights the breakdown point, where the DXY has fallen below the lower trendline of the triangle, which has acted as support for several years.

With this breach, the next major support level is around 95.00, which aligns with the upward trendline established back in 2011. If the DXY continues to weaken, this could have wide-ranging implications for various markets, including commodities, equities, and currencies, particularly those inversely correlated with the U.S. Dollar.

So yes stocks could go up.

Crypto could go up.

Gold could go up.

Keep this development on your radar as we may see increased volatility and potential trading opportunities in the near future.

To Your Trading Success,

Casey Stubbs