🌎 The three most devastating forex crashes in history.

Those Who Do Not Learn History Are Doomed To Repeat It!

Hello traders! 📈

Following yesterday´s email, we´ll talk about the three most devastating forex crashes in history.

All of them have been different but have something in common: they left behind massive losses.

Let´s jump into it!

1. Black Wednesday: September 16, 1992 | -15% | 24 hours

On Black Wednesday, the British pound plummeted against the German mark and U.S. dollar.

The Bank of England's attempts to prop up the struggling pound failed, forcing the UK to withdraw from the European Exchange Rate Mechanism.

The hedge fund manager George Soros famously "broke the Bank of England" by short-selling $10 billion worth of pounds.

The crash wiped out £3.3 billion from the UK's foreign exchange reserves.

2. Swiss Franc Shock: January 15, 2015 | -41% | 24 hours

The Swiss National Bank unexpectedly removed its currency peg to the euro, causing the Swiss franc to soar against the euro and other currencies.

This sudden move caught traders off guard, leading to massive losses for many forex brokers and traders.

Some firms went bankrupt, and others suffered significant financial damage.

Estimates suggest that $5 billion was lost in the forex market that day.

3. Brexit Vote: June 24, 2016 | -12% | 24 hours

The British pound experienced its largest one-day drop in modern history following the UK's vote to leave the European Union.

In hours, the currency fell from $1.50 to $1.32 against the U.S. dollar.

This crash erased nearly $2 trillion in value from global stock markets.

Of course, there are other crushes, but these are some of the biggest we have faced, and they won´t be the last ones.

Being ready for the next crash is unnecessary until you face one. I´m sharing 3 valuable insights you want to take note of.

Insights:

- Diversification is crucial: Don't put all your eggs in one basket. Spread your investments across different currencies and asset classes to mitigate risk.

- Use stop-loss orders: Implement automatic sell orders to limit potential losses during sudden market movements.

- Stay informed and prepared: Keep up with global economic and political news, and always have a contingency plan for various market scenarios.

Don´t wait until the last moment, and protect your money.

Here, you have a reliable way to increase your trading capital.

To Your Trading Success,

Casey Stubbs

P.S. If you want to hop in, use this code, TSG20, and get a discount.

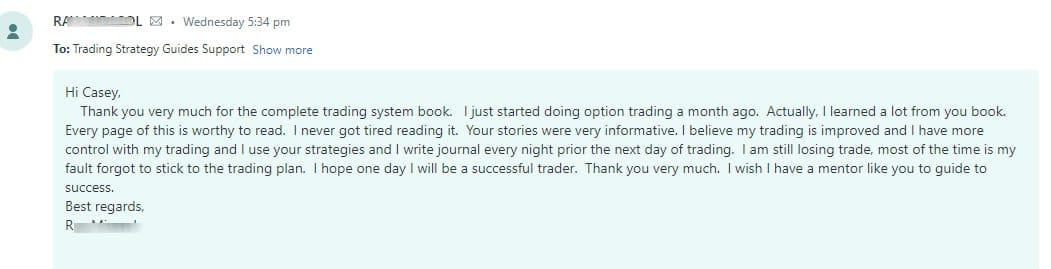

If you want to get some additional training from me and love books, here is a review I just got from my book.

You might want to check it out.