🌎 The best indicators in trading!

Hello traders! 📈

Everywhere, having the right tools at your disposal can make all the difference. Trading it´s not far away from that.

Today, we're diving into the essential technical indicators that can help traders make informed decisions and operate market trends effectively.

Our main source is a guide on technical indicators, covering trend analysis, mean reversion, relative strength, momentum, and volume indicators.

Key takeaways:

- Technical indicators fall into five categories: trend, mean reversion, relative strength, volume, and momentum.

- Popular indicators include moving averages, Bollinger Bands, stochastics, MACD, and on-balance volume (OBV).

- Each indicator type provides unique insights into market behavior and potential trading opportunities.

Understanding these indicators is crucial for developing effective trading strategies and making informed decisions.

The article highlights the importance of simplifying analysis and avoiding information overload, a growing trend in the trading community as markets become increasingly complex.

Technical indicators are essential tools for traders, providing insights into market trends, momentum, and potential turning points.

By focusing on a select few indicators across different categories, you can simplify your analysis and improve decision-making.

You can apply this information by:

- Experiment with different indicator combinations to find what works best for their trading style.

- Start with popular settings for each indicator and gradually adjust them based on performance.

- Trend indicators like EMAs are used to identify overall market direction.

- Incorporating momentum indicators like MACD to spot potential entry and exit points.

- Validating trade ideas with volume indicators like OBV confirms market sentiment.

Mastering technical indicators is a journey that requires practice and patience.

Understanding and applying these tools effectively will enhance your market analysis and potentially improve your trading outcomes.

The key is to start simple and gradually refine your approach as you gain experience.

Do you lack the capital to get the profits of your dreams?

To Your Trading Success,

Casey Stubbs

P.S. If you want to hop in, use this code, TSG20, and get a discount.

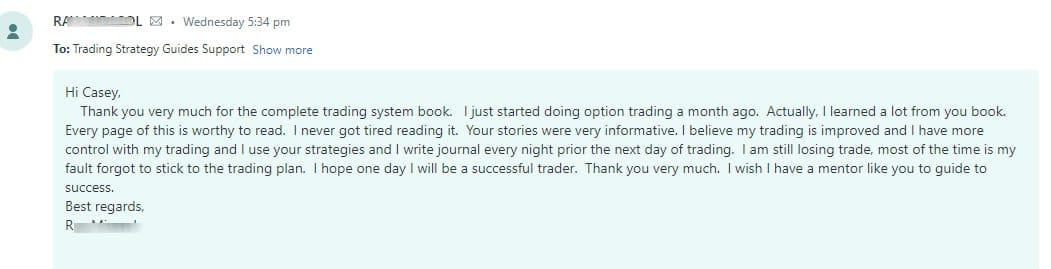

If you want to get some additional training from me and love books, here is a review I just got from my book.

You might want to check it out.