🌎 Meet this trading rule!

Hello traders! 📈

Today, we'll explore how to create a risk management plan tailored for traders with limited capital.

By the end of this newsletter, you'll understand the key components of an effective risk management strategy and how to implement them in your trading.

As you may know, successful trading isn't just about picking winners – it's about protecting your capital.

Let's build on that knowledge and dive into some practical strategies.

The cornerstone of risk management is the 1% rule.

This guideline suggests never risking more than 1% of your trading account on a single trade.

For instance, if you have a $5,000 account, your maximum risk per trade should be $50.

This approach helps preserve your capital, allowing you to weather inevitable losses.

❗️ Here's a quick tip: Use a position size calculator to determine the appropriate lot size based on your account balance and risk tolerance.

Now, let's put this into practice.

Calculate your maximum risk per trade based on your current account balance.

How does this compare to your usual position sizes?

To assess your understanding, review your recent trades.

How many exceeded the 1% risk threshold?

This reflection can provide valuable insights into your current risk management practices.

Moving forward, implement the 1% rule in your next week of trading.

Pay attention to how it affects your decision-making process and overall trading psychology.

Remember, effective risk management is a skill that develops over time.

Stay disciplined, keep learning, and your trading will likely improve.

❓ Lack of capital? Get $25,000 by paying a $250 audition fee.

To Your Trading Success,

Casey Stubbs

P.S. If you want to hop in, use this code, TSG20, and get a discount.

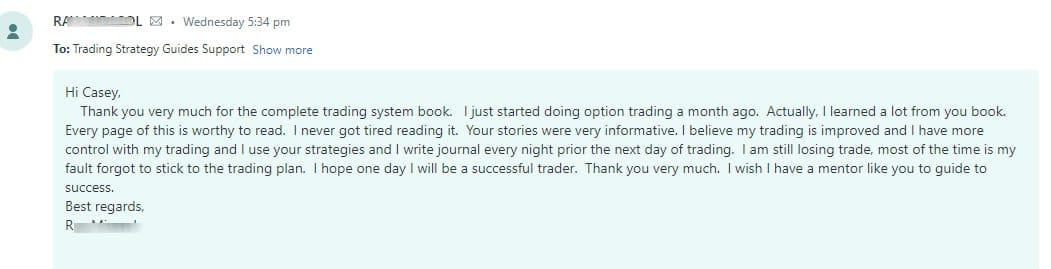

If you want to get some additional training from me and love books, here is a review I just got from my book.

You might want to check it out.