Make Money From this Technical Analysis Right Now.

- SPY is currently trading around $539.12, down -0.90% on the day.

- After a strong recent drop, it’s in the middle of a bounce.

- It rejected at the 200 SMA (orange line) near $573 during the fall — a key resistance now.

- It’s below all major moving averages (20 EMA, 50 EMA, 200 SMA) – a sign of weakness.

📊 Indicators:

- RSI (14): 45.90 → Neutral, but recovering from oversold.

- Stochastic RSI: ~83 → Overbought, signaling potential for pullback.

⚠️ Context:

- Recent strong downtrend, and this bounce might just be a bear market rally.

- Price is approaching resistance from prior support around the $545–$550 zone.

✅ Best Trade Setup Right Now (High-Probability):

Bearish Reversal Play: Call Credit Spread on SPY

You can take advantage of the potential rejection at resistance near the 545–550 level.

Freedom Income Options by Casey Stubbs is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Subscribed

🧠 Setup:

- Trade Type: Bearish Credit Spread (Call Spread)

- Sell 1 SPY $550 Call

- Buy 1 SPY $555 Call

- Expiration: 1–2 weeks out (short-term theta decay + event-driven selloff potential)

- Goal: Price stays below $550 through expiration

📈 Risk/Reward Example:

- Credit: ~$1.00 per spread ($100)

- Max loss: $4.00 per spread ($400)

- ROI: ~25% in 1-2 weeks if SPY stays below 550

🧭 Exit Plan:

- Hold until expiration if SPY stays under $550.

- Stop out if SPY breaks above $555 on strong volume.

🔒 Alternative Conservative Play:

If you're more cautious but still bearish short-term:

Buy a Put Debit Spread

- Buy SPY $535 Put

- Sell SPY $525 Put

- Expiration: 2–3 weeks out

- This gives you directional bearish exposure with defined risk.

📅 Want to Learn How to Trade These Setups for Weekly Income?

Join me live this Thursday at 7 PM EST for a free training:

👉 Register here

You’ll discover:

- How we use Elliott Wave setups like this to time weekly income trades

- The exact system I use to generate 1% per week

- Live trade examples and how to manage risk like a pro

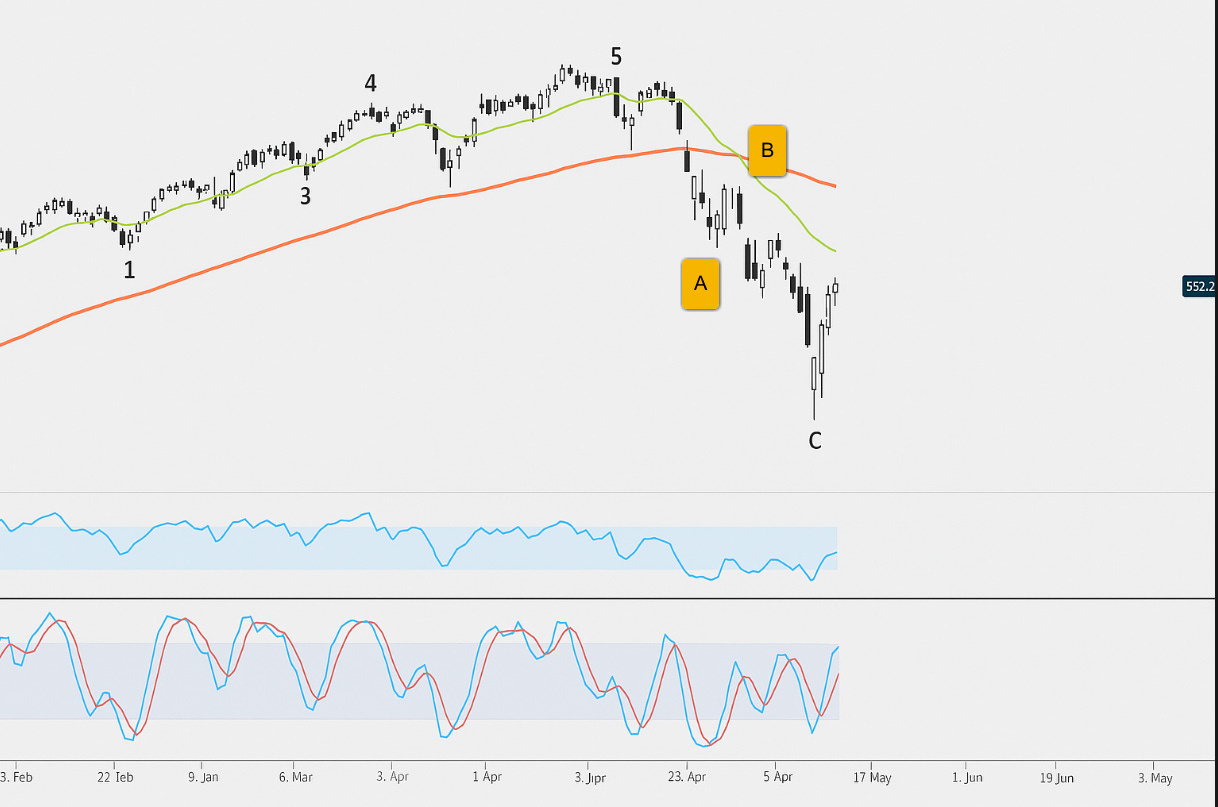

🔍 Elliott Wave Analysis – SPY Daily Chart (Current)

From a high-level view, here's a likely interpretation of the wave count:

1. Previous Impulse Wave Completed (Wave 1–5)

Looking at the rally from October 2022 to March 2025, this appears to be a 5-wave impulse structure:

- Wave 1: Oct 2022 bottom → Dec 2022 rally

- Wave 2: Dec 2022 → March 2023 pullback

- Wave 3: March 2023 → July 2024 (strong, extended bullish leg)

- Wave 4: July 2024 → October 2024 (sideways consolidation)

- Wave 5: October 2024 → March 2025 top

✅ This structure fits cleanly and aligns with Elliott Wave’s guidelines:

- Wave 3 is not the shortest

- Wave 4 does not enter Wave 1 territory

- Wave 5 ends in a blow-off top pattern before the current drop

2. Current Move = Corrective Wave (Likely Wave A of ABC)

- From the March 2025 top, SPY has entered a sharp drop — likely Wave A of a larger ABC correction.

- The recent bounce (last few candles) may be part of Wave B, which typically retraces 38%–61% of Wave A.

- If this is correct, Wave C down is likely next, with SPY potentially heading toward:

- $510 (support zone)

- Or even $495–$485 if Wave C extends

🔮 What Elliott Wave Implies for a Trade Right Now:

- We’re likely in Wave B of a bearish ABC corrective pattern.

- Once Wave B completes (near 545–550 resistance), the next high-probability move is Wave C down.

This aligns perfectly with the bearish call credit spread we discussed earlier.

✅ Elliott Wave Trade Plan

Setup: Prepare to trade the Wave C leg

- Direction: Bearish

- Entry: Around $545–$550

- Target: $500–$510

- Strategy: Put debit spread or call credit spread (as outlined above)

Get Your Replace Income Roadmap:

https://reports.ubpages.com/replace-your-income-roadmap/

Live Training – How to Replace Income with Options:

https://reports.ubpages.com/replace-your-income-webinar/

Read Daily Strategy Updates:

Freedom Income Options by Casey Stubbs

Replace Your Paycheck, Reclaim Your Freedom. Using our weekly income system anyone can replace their current income.

By Casey Stubbs – Freedom Income

caseystubbs@gmail.com

Get High-Probability Trade Alerts:

https://t.me/caseystubbstrading

Follow on X:

https://x.com/Caseystubbs

Watch Trading Strategy Videos on YouTube:

https://www.youtube.com/@freedomincomeoptions

Let’s focus on consistency and let the chaos fuel the edge.