In-Depth Analysis of GBP/JPY and USD/CAD Trades

Let's get ready to trade.

I have a great analysis today.

But first, a little nugget for you to help you get the right mindset.

My biggest hangup in trading was because I was always focused on scaling my accounts and winning a ton of trades.

I truly believed that I had to have some kind of insane profit growth for me to be successful.

You know,

50% growth in a month...

Doubling my account each week.

That type of mindset is the exact reason that it took me so long to be successful with forex trading.

I was trying to grow too fast and it was messing my mind.

Remember this is Forex trading, it's not the same thing as stock trading. You can't look at it the same way.

In stocks, it's possible to double. While in currency trading not possible.

Here is an example:

If you bought Mcdonald's stock in 1980 and held it for 40 + years to today the stock has had a 29,000% increase during that time.

Now if we try to do that in forex it won't work.

The GPBUSD was trading at 1.27 in 1985 and now today it is trading at the exact same price.

Now by looking at those charts, you see you have to have a different strategy and mindset for Forex.

The reason currency prices move the way they do is because of central banks controlling interest rates.

They manipulate the currency so that inflation is under control. They are essentially managing debt.

Here is how i finally made a breakthrough In forex...

I realized I didn't have to double or triple my account. I just had to be consistent.

Make 1 to 3% a month and take the very best setups I could find.

That 1% a month equals 12 percent per year and if I can secure funding and earn more money off of the consistency.

I hope that helps now let's get to the analysis for this week.

GBP/JPY Analysis:

- Bounce from Key Level: The GBP/JPY has consistently bounced off the 180 level approximately four times on a weekly chart. This repeated pattern indicates strong market behavior around this level.

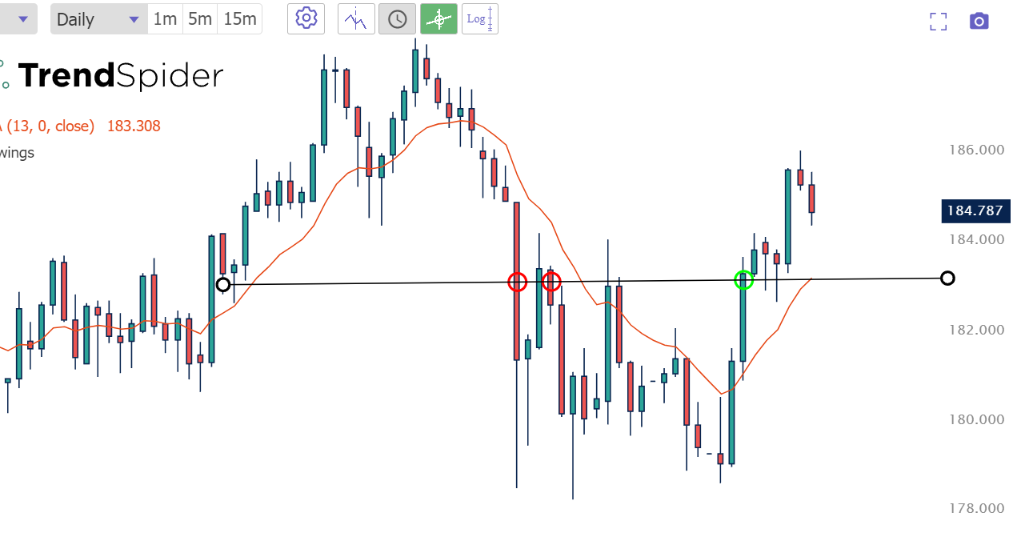

- Megaphone Pattern and Key Resistance Break: We're observing a megaphone pattern, and notably, the pair has just crossed above a significant resistance point at around 184, which it struggled with in the past three weeks.

- Potential for Reversal: Despite recent pullbacks, the daily timeframe shows potential for the pair to drop a bit more.

A breakout from the current downtrend, particularly on the one-hour timeframe where a clear 10 EMA and trend line is visible, could signal a strong long trade opportunity.

For GBP/JPY, we will consider an entry on a breakout of the current downtrend, setting our stop loss below 180 and targeting 190.

This is an example of a top-down analysis of weekly, daily, and hourly charts to make a trading decision.

USD/CAD Analysis:

- Sideways Pattern on Weekly Chart: The USD/CAD has been in a tight range between 132 and 140 for about a year. This prolonged sideways movement signals a buy off the bottom of the channel.

- Morning Star Pattern and Resistance Break: A morning star pattern formation and a break above the previous three weeks' close around 134 indicate a bullish momentum.

Do you see the morning star in the chart above?

- Potential for Upward Movement: Looking at the daily chart, a close above the previous day’s high of 134.50 could lead to reaching targets around 135 or 136.

In the case of USD/CAD, I went on a long position, setting my stop loss below 132.

Our principles of planning, consistency, and diversification in trading are key to market success.

Remember, always stay vigilant and adapt to market changes.

To Your Trading Success,

Casey Stubbs

P.S. If you want to learn about an indicator I developed to help me trade this, I am teaching live tomorrow. Click here to Join me.